Oracle NetSuite Tax Compliance for Peru

The LatamReady App extends the power of Oracle NetSuite Cloud ERP to enable international corporations to achieve full tax compliance in Latin America.

An innovative Built-for-NetSuite solution, the LatamReady App natively supports Tax & Accounting Compliance, Tax Reporting, Electronic Invoicing, and many more amazing features for 18+ Latin American countries, including Peru!

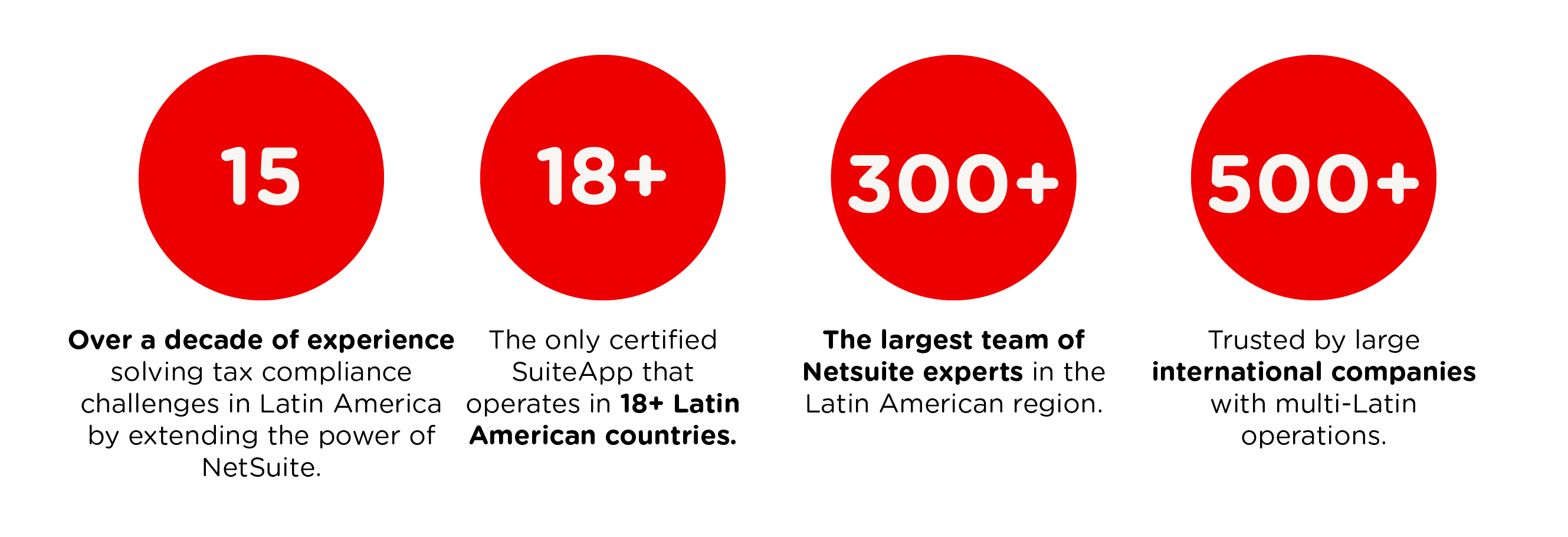

About LatamReady

Tax Determination &

Tax Information Reporting Features for Peru

The LatamReady App is always up to date with all monthly and annual tax reporting forms (Tax Authority - SUNAT), making it easy for companies to comply with local tax reporting requirements in Peru.

The LatamReady App fully supports NetSuite's multi-booking feature and includes the following ledgers for legal reporting in Peru (Tax Authority - SUNAT):

Tax Rules & Tax Calculation Features for Peru

Tax Calculation

Tax Agencies

Withholding Tax Certificates Formats

Local Tax ID Validation

Letras

NetSuite MidMarket Edition

Localized Expense Reports

Exclusive Peru Features

Electronic Invoicing

Features for Peru

Send E-Invoices Directly from Inside of NetSuite

Electronic Payments

Features for Peru

LatamReady Supports Massive Bill Payments

LatamReady Add-Ons

NetSuite Editions:

OneWorld & Midmarket Edition / SuiteTax & Legacy

Customer Care Support

For Peru

Always Up to Date!

Our service includes unlimited legal updates for 18+ Latin American countries.

Tax rules in Peru are continuously changing and evolving.

LatamReady, combining local tax advisory in each country and the biggest NetSuite software factory in the region, will ensure that your subsidiary always remains compliant.

Included in your annual subscription is unlimited customer care support in 3 languages: English, Portuguese, and Spanish.

Additionally, LatamReady releases 2 official versions per year, always Built-For-NetSuite certified by Oracle.

LatamDojo

E-Learning Platform

NetSuite Training on Demand

Schedule a Call with

a NetSuite Expert!

Safe Harbor Statement

Peru Is Ready!

Are You?