Oracle NetSuite Tax Compliance for Guatemala

The LatamReady App extends the power of Oracle NetSuite Cloud ERP to enable international corporations to achieve full tax compliance in Latin America.

An innovative Built-for-NetSuite solution, the LatamReady App natively supports Tax & Accounting Compliance, Electronic Invoicing, and many more amazing features for 18+ Latin American countries, including Guatemala!

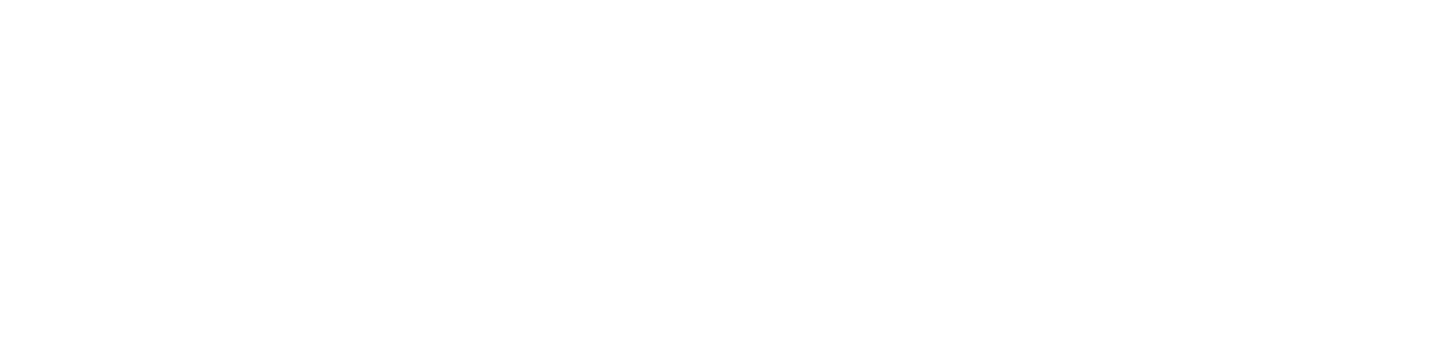

About LatamReady

LatamReady

App Guatemala

LatamReady App Guatemala - Standard Features

Electronic Invoicing

Features for Guatemala

Send E-Invoices Directly from Inside NetSuite

Electronic Payments

Features for Guatemala

LatamReady Add-Ons

NetSuite Editions:

OneWorld & Midmarket Edition / SuiteTax & Legacy

Customer Care Support

for Guatemala

Always Up to Date!

LatamDojo

E-Learning Platform

NetSuite Training on Demand

Schedule a Call with

a NetSuite Expert!

Chart of Accounts:

Legal Ledgers:

Average Costing:

Safe Harbor Statement