Oracle NetSuite Tax Compliance for Ecuador

The LatamReady App extends the power of Oracle NetSuite Cloud ERP to enable international corporations to achieve full tax compliance in Latin America.

An innovative Built-for-NetSuite solution, the LatamReady App natively supports Tax & Accounting Compliance, Tax Reporting, Electronic Invoicing, and many more amazing features for 18+ Latin American countries, including Ecuador!

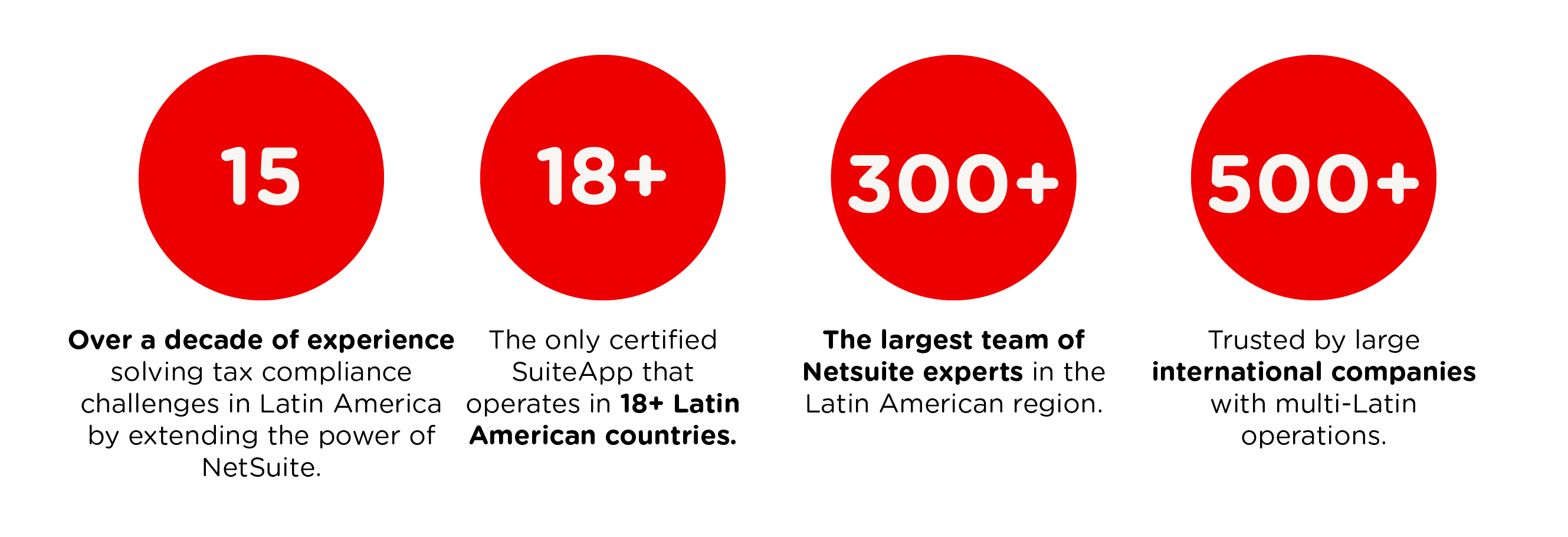

About LatamReady

LatamReady App Ecuador

The LatamReady App is always up to date with all monthly and annual tax reporting forms, making it easy for companies to comply with local tax reporting requirements in Ecuador.

LatamReady App Ecuador - Standard Features

1. Local legally required information (RUC, Tipo de persona, Reg.Fiscal Preferente)

2. Local transaction types and information required to produce legal ledgers required by ATS (Ecuadorian Tax Agency)

3. Withholding Taxes Engine using NetSuite standard feature: IVA, IR, Fuente, Honorarios.

4. Purchases Withholding Taxes e-Certificates numbering

5. The report with the nine (9) documents needed to be uploaded via the official macro provided by ATS (CSV & XML format):

6. Set of 11 Reports/Audit Reports/Searches/Alerts developed by LatamReady

i. Is a set of non-legal reports

ii. This set of reports has been developed to be used to analyze, review and validate the information to be sent to SRI (Ecuatorian Tax Agency)

7. Generation of a report including:

i. ATS en Ventas a Clientes

ii. ATS Compras

iii. ATS Retenciones a la Compra

Tax Agencies

We work in an integrated way with the tax agencies of each country we serve; in Ecuador, we work with Servicios de Renta Interna.

Electronic Invoicing

Features for Ecuador

Send E-Invoices Directly from Inside NetSuite

Electronic Payments

Features for Ecuador

LatamReady Supports Massive Bill Payments

LatamReady Add-Ons

NetSuite Editions:

OneWorld & Midmarket Edition / SuiteTax & Legacy

Customer Care Support

For Ecuador

Always Up to Date!

Our service includes unlimited legal updates for 18+ Latin American countries.

Tax rules in Ecuador are continuously changing and evolving.

LatamReady, combining local tax advisory in each country and the biggest NetSuite software factory in the region, will ensure that your subsidiary always remains compliant.

Included in your annual subscription is unlimited customer care support in 3 languages: English, Portuguese, and Spanish.

Additionally, LatamReady releases 2 official versions per year, always Built-For-NetSuite certified by Oracle.

LatamDojo

E-Learning Platform

NetSuite Training on Demand

Schedule a Call with

a NetSuite Expert!

Chart of Accounts:

Legal ledgers:

Average Costing:

Safe Harbor Statement

Ecuador Is Ready!

Are You?